What is grid trading?

Grid trading, also known as fishing net trading, is a market investment strategy. Based on the core idea of buying low and selling high, it applies to a volatile market of digital currencies: we might as well regard the volatile market as a finish going up and down, while grid trading is like a fishing net. This “net” can grasp the “finish” in the correct position so as to make profits through buying or selling.

In a grid trading strategy, buy stop entry orders are placed above the current market price. These orders will automatically enter you into a long position if a bullish breakout occurs. Sell stop entry orders are then placed below the current market price to trigger a short position in the event of a bearish breakout. Grid strategies can be used in both trending and choppy markets, but they’re more effective in the former.

How to use grid trading

1.Choose the right target token

According to the characteristics of grid trading, it’s easier to gain profits in a volatile market. Consequently, investing in a target token with a volatile market (such as bitcoin) can make full use of the advantages of grid trading. The stronger the volatility of the market, the easier it is to approach the buy and sell prices. And the more times you buy and sell, the more profits you get.

2.Estimate the current market

The grid trading strategy is most suitable for a volatile market environment. Once the market rises unilaterally, it is easy to sell out the purchased assets; once the market drops unilaterally, it is easy to use up the invested funds. However, Gate.io grid trading has an automatic stop-loss/stop-gain price function, which will determine the stop-loss and take-profit in time.

3.Make grid trading strategies

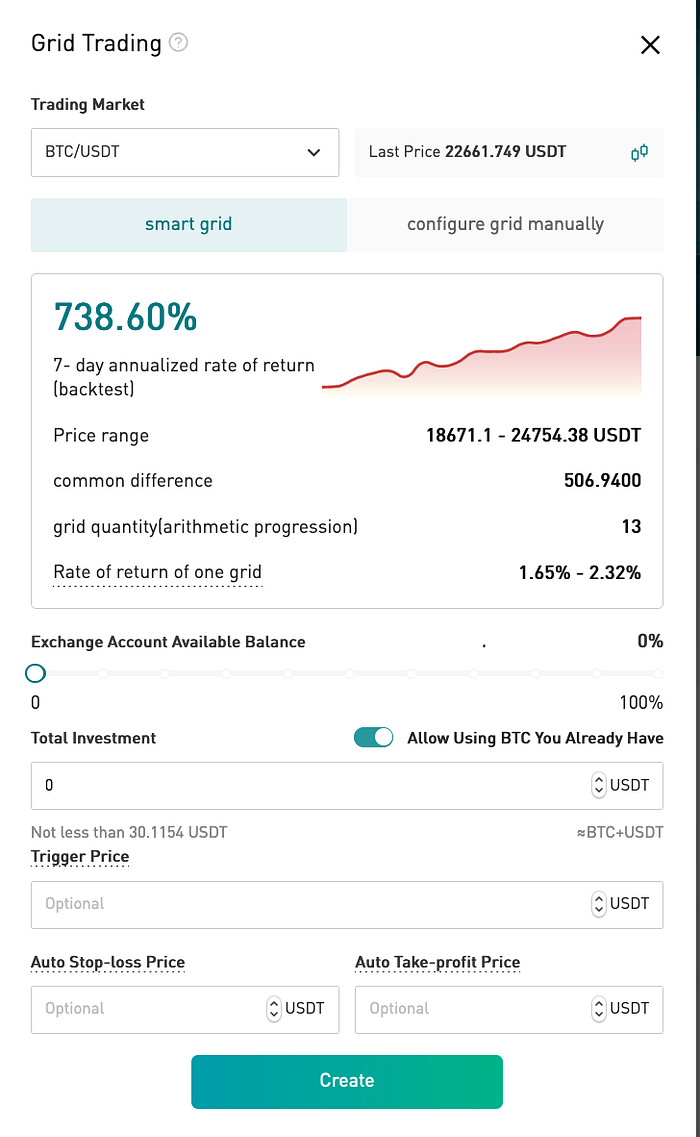

At Gate.io, there are two types of grid trading: AI smart grid and manual configuration grid. If you still have some doubts about grid trading but want to try it out, you can use the Gate.io AI Smart Grid; if you already understand grid trading, you can choose to use the manual configuration grid and set the parameters.

Step 1: Set the range of grid price

The range of grid price refers to the upper limit price and the lower limit price. Within this range, the will automatically create buying and selling orders according to the grid settings. And it will trigger a trade after the price fluctuations. When using the contract grid function, you also need to select the leverage, currently up to 10x.

Step 2: Set the number of grids and the number of buys and sells per grid

The will divide the whole price range into several networks according to the number of grids you have set that will directly affect the single grid yield below. (The minimum single grid profit will > 2 times commission)

Step 3: Set automatic stop-loss/take-profit price or percentage (optional)

Set stop-loss price: when the price of a token falls below the stop-loss price, all the holding token will be sold out,

Set take-profit price: when the price of token rises above the take-profit price, the take-loss is triggered and the strategy will end and cancel all open buy orders automatically.

If you are a novice, we recommend that you use the parameters suggested by the Gate.io AI smart grid. If you have some trading experience, you can refer to the parameters suggested by AI smart grid or previous experiences to judge for yourself and set the parameters directly.

Grid Trading Terminology

Upper limit price: is the highest sell price, which means you believe the current market price will not exceed this price. You can refer to the historical data or the upper edge of the Bollinger Bands (BOLL UB) to get this value. If the last price on the market is higher than the upper limit price, no sell order will be placed.

Lower limit price: is the lowest buy price, which means you believe the current market price will not fall below this price. You can refer to the historical data or the upper edge of the Bollinger Bands (BOLL UB) to get this value. If the last price on the market is lower than the lower limit price, no buy order will be placed.

Click [Indicator] on the chart, search for “BOLL” in the search bar, and click on the search result to display the Bollinger indicator on the chart.

Central Price

It is the middle of the upper limit price and the lower limit price, which can be interpreted as the price around which you think the market will fluctuate in that period.

Arithmetic progression grids

Each grid trades on a grid with equal spreads between each grid. Suitable for coins with relatively small market volatility.

Geometric progression grids

Each grid is traded in a grid of equal proportional amounts, with each grid having the same rate of return for a single grid. Suitable for coins with relatively greater market volatility.

Number of Grids

The number of grids is related to the frequency of trading, if the number of grids is set too high it may lead to too many trades, if the number of grids is set too low it may lead to a long time without trading. To determine the number of grids we need to use a common indicator — ATR Average True Volatility.

When the ATR fluctuation is greater than the grid spread, the chance of closing increases and the grid gain increases, i.e., ATR > grid spread = (upper price — lower price) / number of grids, so we can use (upper price — lower price) / ATR to calculate the appropriate number of grids.

Click on “Indicators” on the chart page, search for “ATR” in the search bar, and click on the search result to display the ATR indicator on the chart page.

ATR (Average True Range)

ATR is a moving average of price fluctuations over a certain period of time and is mainly used to help users judge the timing of buying and selling, dynamic position adjustment/stop-loss, etc.

Single-grid yield

The higher the number of grids, the lower the single-grid yield, given the same interval.

Grid Density

It refers to the size of each grid. The higher the number of grids, the higher the density of the grid, the more it can capture small fluctuations in the market, and the more frequent the number of transactions, while the revenue of a single grid will decrease and the commission will increase. The smaller the number of grids, the lower the number of transactions, the more frequent the individual grids will be, and the lower the fees.

Total amount of investment

Refersto the total amount of money invested in this grid transaction. If you feel that the amount of profit is not enough, you can increase the principal amount of each grid or reduce the number of grids to make them bigger and thus expand the individual grid earnings.

Grid Spread

The amount of investment that can be traded per grid by dividing the total investment by the number of grids.

Auto Stop-Loss Price (optional)

When the latest market price is less than or equal to this price, the stop-loss will be triggered automatically and the buying will be stopped. (This price setting must be less than the lower limit price)

Auto Take-Profit Price (optional)

When the latest market price is greater than or equal to this price, automatically triggers a take-profit and sells all. (This price setting must be higher than the upper limit price)

Backtesting

In trading strategies, backtesting is used to uate the performance of a strategy or computational model over time.

Grid Trading Risks

Continuous one-sided market, price fluctuations beyond the grid

When the market continues to rise unilaterally, the user’s position has been sold short and cannot take profit; when the market continues to fall unilaterally, the user will suffer a large floating loss.

The market does not move within the set range

If the market trend does not enter the price range you set, it may lead to inefficient use of invested funds.

Gate.io AI Smart Grid Trading

Gate.io AI smart grid trading is based on the last 7 days of historical data for backtesting, and automatically calculates the highest yield grid parameters (upper limit price, lower limit price, number of grids). Therefore, you only need to fill in the proportion of the investment amount to create an AI smart grid trading strategy. It’s very friendly to novice investors.

More information about Gate.io grid trading: Grid Trading Manual

Gate.io is an established exchange that holds integrity, transparency, and fairness to a very high standard. We charge zero listing fees and only choose quality and promising projects. Our exchange consists only of 100% real trading volume. Thanks to everyone who has joined us in our journey. We always intend to improve and innovate to reward our users for their continuous support.